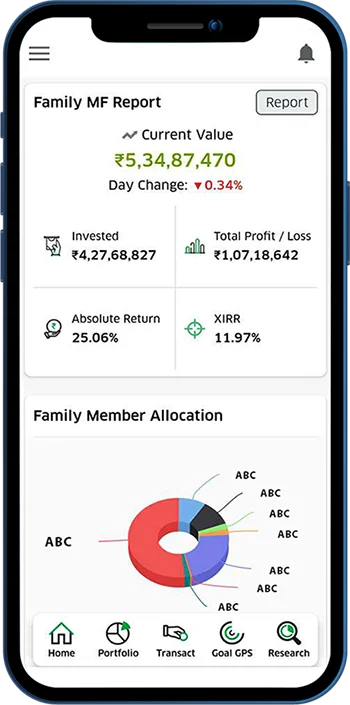

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

PARTNERS

Trusted Collaborations with Leading AMCs

ABOUT US

Who We Are

Sumit Dalima has proudly served the financial community for over 12 years, establishing itself as a trusted name in the investment sector. With a focus on providing comprehensive and personalized financial solutions, we cater to a diverse clientele, ranging from individuals to businesses looking to grow and protect their wealth. Our expertise spans across a wide array of financial products, including Mutual Funds, SIPs, Life and Health Insurance, Fixed Deposits, Bonds, AIFs, and more.

SERVICES

What We Provide

Mutual Fund

Investment options diversifying portfolios in stocks, bonds, or securities, professionally managed for long-term wealth growth.

Mutual Fund

Investment options diversifying portfolios in stocks, bonds, or securities, professionally managed for long-term wealth growth.

SIP (Systematic Investment Plan)

Systematic Investment Plan (SIP) allows regular investments in mutual funds over time.

SIP (Systematic Investment Plan)

Systematic Investment Plan (SIP) allows regular investments in mutual funds over time.

Investment Planning

Investment Planning is the process of organizing your finances to achieve your financial goals.

Investment Planning

Investment Planning is the process of organizing your finances to achieve your financial goals.

Goal-Based Investment Solutions

Goal-Based Investment Solutions is a holistic approach to Investment Planning and safeguarding your wealth.

Goal-Based Investment Solutions

Goal-Based Investment Solutions is a holistic approach to Investment Planning and safeguarding your wealth.

Retirement Investment Strategies

Retirement Investment Strategies involves strategic financial preparation and investment strategies to secure a comfortable retirement phase.

Retirement Investment Strategies

Retirement Investment Strategies involves strategic financial preparation and investment strategies to secure a comfortable retirement phase.

Tax-Efficient Investment Options

Tax-Efficient Investment Options strategies aim to minimize tax burdens while maximizing savings within established financial regulations.

Tax-Efficient Investment Options

Tax-Efficient Investment Options strategies aim to minimize tax burdens while maximizing savings within established financial regulations.

Your Financial Journey Simplified!

For Individuals

Investment Solutions Aligned with Your Financial Goals

- Customized investment strategies to achieve your life goals.

- SIPs for consistent and disciplined wealth creation.

- Tax-efficient investment options like ELSS to save under Section 80C.

- Investment guidance for child’s education, retirement, and emergency funds.

- Regular portfolio reviews to optimize returns.

For Small Medium Enterprise

Tailored Investment Planning for Your Business Growth

- Customized mutual fund strategies for short- and long-term goals.

- Liquidity management with liquid and debt funds.

- Efficient reserve fund growth for contingencies and business expansion.

- Tax-efficient investments to minimize business tax liabilities.

- Portfolio tracking to ensure alignment with financial objectives.

SIP

Power Of SIP

SIP

Power Of SIP

FEATURES

TOP FEATURES WE PROVIDE

-

Portfolio Analysis

-

Video Kyc

Experience seamless and secure Video KYC for investments. Complete the process in just a few minutes from the comfort of your home. Simplify SIP registration or ELSS purchases with our 100% paperless and hassle-free solution.

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.

Journey In Focus,

Marking Progress Every Day!

Dalmia Investment AMFI-registered Mutual Fund Distributor is a one stop solution for all your mutual fund and SIP investments. The users have access to all the leading asset management companies. Users can login and easily track all their investments at one go.

Assets Under Management

Happy Clients

Years Of Experience

Awards

Testimonials

What People Say

We have been working with Dalmia Investment for a very long time now. They have always provided sound financial advice and have guided us on the best investments. The staff (especially Anukta ma'am) is extremely supportive...

Sayantani Banerjee

All the staff members are very polite and helpful. You can expect immediately reply from them for any of your queries and they are keen to provide you with guidance throughout your investment journey :) ...

Rukhsar Aziz

Great investment advisory.. prudent fund selection catering to the needs of all demographics across India. A must visit if you need assistance with financial planning or portfolio management. ...

Shrayan Duari

All staff and the owner of this organisation are extremely helpful and they go out of their way to see the benefits of their clients.I will highly recommend and I myself has also told many...

Mihir Ghosh

The Dalmia Investment team is like an extended family to me. The team members are extremely knowledgeable and up to date with all the regulatory changes and market movements (and they are always available for a discussion,...

Jayabrata Dasgupta

This is one of the best platforms for layman's like us to invest their money on profitable mutual funds.All the employees behave gently and they don't think us as customers rather as a family member.I...

Anik Chakraborty

They provide excellent services to the investor. I am very happy for their service. Staffs are also extremely helpful. They also share the fund performance related news & provide guidance time to time. ...

Rakesh Pradhan

I required investment advice for a lump-sum investment on behalf of my mother. Dalmia Investment provided me with a solution that acts as a roadmap to my financial needs. ...

gargi roy

All staff and the owner of this organization are extremely helpful and go out of their way to ensure the best outcomes for their clients. They stay updated with the latest developments in the field...

Mihir Ghosh

I had an outstanding experience with Anukta madam from Dalmia Investment. Their expertise, professionalism, and personalized approach were exceptional. They took the time to understand my financial goals and tailored a comprehensive plan that...

.png)

Ajit Kumar Ray

I had put my faith in Dalmia Investment many years ago, and have not regretted a single day. They not only made themselves aware of my financial aspirations, but also understand psychology, so as...

.png)

Suhrid Chattopadhyay

Dalmia Invest has been managing my investments very efficiently. All the employees are quite knowledgeable and are respectful. Their advice is balanced and is appreciated since they always have the benefit of their clients...

.png)

sujay biswas

The Dalmia Investment team is like an extended family to me. Their client 'first' approach is unique and refreshing at this day and age. The team members are extremely knowledgeable and up to date with all...

.png)

Jayabrata Dasgupta

My experience of working with Dalmia Investment is very satisfactory thanks to its professionalism as reflected in the prompt service, courteous behaviour of the staff and capping it all reliability. The investors' interest, I...

.png)

Santanu Sanyal

The Dalmia Investment is such a Organization, where we can depend our Investment, through their honest and sincere guidance. Wish all the best. ...

.png)

BONY HALDAR

Over and above the commercial services, between myself and Dalmia Investment the bonding is like family members since 2005. So far the services concerned, it is excellent. We work one is to one basis...

.png)

Narayan chandra De

*I have been investing in mutual fund through Dalmia Investment since 2005 and I am more than satisfied with their services. Mr CM Mukherjee guides me with valuable inputs through out my journey with...

.png)

Sujit Banerjee

Very professional firm. Most of the transactions can be done online. Promptly addresses all queries. Also manages the portfolio in a professional manner. I had many helpful tips from them regarding my portfolio. All members...

.png)

PROBAL MITRA

I am with team Dalmia Investment since long. My small savings are safe with their investment guidance. They are a caring lot of professionals who understand individual requirements and guide accordingly. Even with the smallest amount...

.png)

sarbari ghoshal

They provide excellent services to the investor. I am very happy for their service. Staffs are also extremely helpful. They also share the fund performance related news & provide guidance time to time. Wishing Ace...

.png)

Rakesh Pradhan

My experience with them as under: Provide honest advice on financial investment as per customer need/profile. After sale service was outstanding. Rare quality, In case the fund was not performed they come out with solution immediately. All...

.png)

Ranabir Pal

A team of brilliant financial advisors led by a veteran in this field, Dalmia Investment is a one stop solution for anyone and everyone who wishes to invest and create weath for themselves. Their money...

.png)

bakhteyar azam

I have been investing with Dalmia Investment for two decades or more. To be more precise, I learnt investing from Ace. I am no financial illiterate. As a financial journalist, probably I knew a bit...

.png)

Pratim Bose

Dear Team ACE, Your prompt services, suggestions and support are truly commendable. Special thanks to Chandramohan sir, Anukta madam and associates for taking every care in understanding my investment needs, patiently suggesting & explaining the options and...

.png)

Koyel Mallick

Just awsome guidance regarding mutual fund investments. Excellent services. Very much cooperative with professional approach. Highly recommend. I and my wife are investing under guidance of Mr CHANDRAMOHON MUKHERJEE , PROPRIETOR , Dalmia Investment ,...

.png)

DR DIPANKAR GHOSH (Deepupahari)

AFS means business. They are very professional, trustworthy, polite and reliable. In short they Dalmia Investment in their Financial Services. I’m totally dependent on them now. Keep up the great work 👍🏻 ...

.png)

Saikat Chakrabarty

The clarity remains depicted in the name of the Company. Once I came across this Company my search was over regarding my financial advises and investment quarries. Very helpful service people with a witty man...

.png)

Rathin Pal

Your one stop solution to all your investment needs. If you are looking for someone to advice you on where to invest your funds so that you get the most out of it, trust me...

.png)

Debdip Roy Chowdhury

View Latest Funds Details

Fund Performance

FAQ

Frequenlty ASK Questions

A SIP is a disciplined way to invest a fixed amount regularly in mutual funds. The amount is automatically deducted from the investor's bank account daily, weekly, or monthly, helping to build wealth over time.

You can start a SIP in Mutual Funds with as little as ₹100, making it accessible for everyone.

An STP allows you to transfer a fixed amount or specific units from one mutual fund scheme to another at regular intervals, ensuring a smooth reallocation of funds without manual intervention.

SWP enables regular withdrawals from your mutual fund investment. Investors can decide the withdrawal frequency and amount, providing a steady income stream, ideal for retirees or those needing periodic funds.

An NFO is the launch of a new mutual fund scheme by an Asset Management Company (AMC). During the subscription period, investors can purchase units at a predefined price.

Have any questions in mind?

Let us help you

Mail Us:

Reach Us:

C- 5012 Arihannt Complex, Udhna Main Road, Surat - 394210

Send A Message